Understanding Forex and the Importance of a Lot Size Calculator

The foreign exchange market, or Forex as it is commonly known, is the global marketplace for trading national currencies. Its vastness, liquidity, and accessibility have made it the largest and most active financial market in the world. With the opportunity to trade 24 hours a day, five days a week, Forex attracts both novice and experienced traders from all over the world. While there are myriad factors and tools that play a role in successful forex trading, one tool that often stands out in its importance, especially for risk management, is the lot size calculator.

What is a Lot in Forex?

In Forex trading, a ‘lot’ refers to a standardized quantity of a particular currency pair that traders can buy or sell. Traditionally, standard lots represent 100,000 units of the base currency. However, with the advent of online trading platforms, brokers began offering different lot sizes to cater to traders with varying capital sizes and risk appetites. Thus, besides the standard lot, there are also mini lots (10,000 units), micro lots (1,000 units), and even nano lots (often 100 units or less).

Determining the right lot size is crucial because it directly impacts your risk exposure. For instance, a miscalculation can lead to either taking on too much risk or underutilizing your capital.

Why is a Lot Size Calculator Essential?

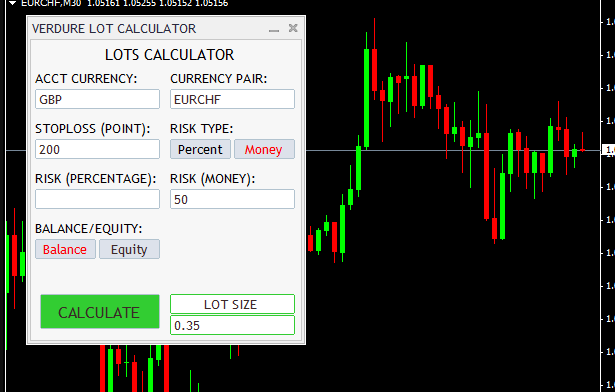

- Risk Management: One of the cardinal rules of trading, not just in Forex, but in any market, is never to risk more than you’re willing to lose. A lot size calculator helps traders determine the right amount of lots to trade based on their risk tolerance. By entering parameters such as account size, risk percentage, and stop loss in pips, traders can quickly ascertain the optimal lot size for their trades.

- Profit and Loss Planning: A lot size calculator not only helps in determining risk but also in projecting potential profit and loss. By knowing how much one pip is worth for a given lot size, traders can set realistic profit targets and stop losses.

- Efficiency: Forex trading requires quick decision-making, especially in volatile markets. A lot size calculator speeds up the decision-making process by instantly providing the trader with the right lot size, based on the given parameters.

- Adapting to Market Conditions: As the Forex market can be very dynamic, a trader’s strategy might change based on current conditions. A lot size calculator ensures that traders can adapt quickly, recalculating lot sizes on-the-fly as market conditions, strategy, or risk appetite changes.

How to Use a Lot Size Calculator:

- Input Your Account Balance: Start by entering your current trading account balance.

- Determine Your Risk Percentage: This is a personal decision. Some traders are comfortable risking 1% of their account balance, while others might be more conservative or aggressive.

- Enter Stop Loss in Pips: This is the number of pips away from your entry price where you’ll close the trade to limit losses.

- Calculate: With the above data entered, the lot size calculator will provide the ideal lot size for your trade, ensuring you stay within your preferred risk parameters.

In Conclusion:

Forex trading, while offering immense opportunities, is also fraught with risks. Tools like the lot size calculator play an indispensable role in ensuring that traders can navigate the choppy waters of the Forex market with a clear understanding of their risk exposure. Whether you’re a seasoned trader or just starting out, the utility of such a calculator cannot be overstated.

Moreover, with advancements in technology and trading platforms, many modern lot size calculators are now integrated into trading platforms, allowing traders to make informed decisions in real-time. As with all tools, remember that while the lot size calculator provides valuable insights, it’s essential to combine its use with a comprehensive trading strategy and continuous learning.