Should Crypto Casinos Self-Insure Players An In-Depth Analysis

Should Crypto Casinos Self-Insure Players? An In-Depth Analysis

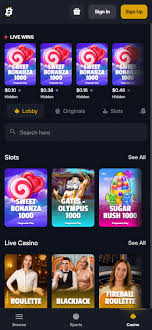

The rise of cryptocurrency has transformed many industries, and online casinos are no exception. As the popularity of crypto gambling continues to climb, questions regarding player protection and the operational integrity of these casinos have emerged. One pressing issue is whether crypto casinos should consider self-insuring their players. Should Crypto Casinos Self-Insure Player Funds? Bitfortune casino presents an ideal case study to explore this topic further.

The Current State of Crypto Casinos

The landscape of online gambling has shifted dramatically with the introduction of blockchain technology. Crypto casinos offer numerous advantages over traditional platforms, including anonymity, faster transaction times, and lower fees. However, these advantages come with challenges, particularly in terms of regulatory compliance and player security.

Understanding Self-Insurance

Self-insurance refers to the practice of a business setting aside a portion of its revenues to cover potential losses rather than purchasing insurance from a third party. This mechanism can be attractive for crypto casinos, as traditional insurance options may not always be available or feasible due to the unique risks associated with blockchain technology and digital assets.

Benefits of Self-Insurance for Crypto Casinos

There are several key benefits surrounding the self-insurance model for crypto casinos:

- Cost-Effectiveness: Purchasing insurance can be expensive, especially for newer casinos. By self-insuring, casinos can allocate those funds in more strategic ways that support both player experiences and operational growth.

- Increased Player Trust: Players may feel more secure knowing that a casino has a financial reserve specifically for payouts and unforeseen circumstances, fostering a sense of trust and commitment to fair play.

- Agility in Operations: Managing payouts directly allows casinos to respond more swiftly to player needs and market changes without the bureaucracy that comes with traditional insurance claims.

Risks of Self-Insurance

While self-insurance can offer notable benefits, it is not without its risks. Some challenges to consider include:

- Financing Limitations: If a casino underestimates potential losses, it may find itself unable to meet player demands during a critical moment.

- Regulatory Scrutiny: Depending on local laws, regulators may impose requirements that prohibit cryptocurrencies from being self-insured, pushing casinos toward traditional insurance models.

- Market Volatility: Crypto markets can fluctuate dramatically, which may affect the adequacy of reserves set aside for player payouts.

Case Studies of Crypto Casinos and Self-Insurance

To better understand the implications of self-insurance, let’s explore some notable examples in the crypto gambling space.

Bitfortune Casino

Bitfortune casino is an interesting case where self-insurance might be particularly beneficial. The platform combines cryptocurrency transactions with the demand for immediate payouts, making the need for financial reserves apparent. By establishing a self-insurance fund, Bitfortune could not only protect its players but also build a reputation for reliability within the crypto gambling community.

Regulatory Aspects of Self-Insurance

One of the primary considerations for crypto casinos is understanding the regulatory environment in which they operate. Each jurisdiction has specific laws governing online gambling, and not all may recognize self-insurance as a sufficient means of protecting players. Compliance with these regulations is crucial. By clearly communicating their self-insurance strategies, casinos can affirm their commitment to player safety and transparency.

Conclusion: A Path Forward for Crypto Casinos

In conclusion, the question of whether crypto casinos should self-insure is multifaceted. Factors such as operational agility, cost management, and player trust weigh heavily in favor of self-insurance. However, casinos must carefully navigate the accompanying risks and regulatory challenges. Ultimately, as the industry adapts and matures, a hybrid model that includes aspects of self-insurance alongside traditional insurance might emerge as the most viable solution. The key is ensuring that players feel safe, secure, and valued in this rapidly evolving digital landscape.